By Arron Lewis, Kevin Cornish, and Dean Siegrist

Planning for today's distribution networks is a little like driving down a foggy road at night. knowing what's ahead and having more visibility makes a ride like that easier, but the clarity those two conditions provide is lacking for utilities and other players in the power sector as they travel toward a modernized grid.

Not surprisingly, survey responses for Black & Veatch's 2019 Strategic Directions: Electric Report reflect this circumstance. Electric industry participants are still finding their path along the road to a distributed power system with lots of intermittent renewables, hard-to-predict load patterns such as those EVs will bring, and the potential of energy storage.

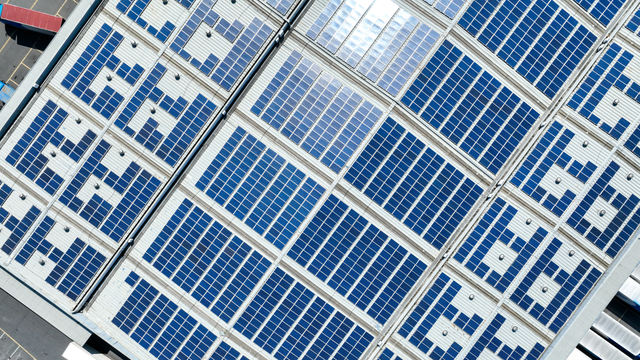

Overall, 77 percent of survey respondents reported that the adoption of renewable energy has increased in their states over the past 18 months. The economics of various types of distributed generation has reached a point where customers are deploying them in progressively larger numbers. This is something all utilities are facing, although utilities in an area with high penetrations of DERs are facing it more immediately.

A big problem this creates is that utilities are left managing distribution systems that are affected by generation resources the utility may not own. Utilities also may lack visibility or control of those resources – or be unable to completely depend on them when system conditions demand a response. When asked what tools or resources are most essential for the planning, engineering, construction, operation and maintenance of a more complex grid, 45 percent of utility respondents cited innovative system designs that allow for more flexibility in system configurations. Nearly half – 47 percent – said better modeling and forecasting data and programs, while 42 percent cited more real-time telemetry and control devices among their top-three picks.

Providers to the power sector don’t necessarily agree, however. Survey respondents from companies doing such things as building out EV charging infrastructure and adding battery energy storage systems to help them cut demand charges at their facilities are facing interconnection delays. And sometimes, utility processes and requirements haven’t caught up with the new paradigm and increased demand. That’s likely why six of every 10 respondents who are providers to the electric industry want innovations that support flexible system configurations; 45 percent of electricity providers want the same.

Here’s one thing all utilities share: They want to deliver safe, reliable and cost-effective power, all while challenged with generation and other grid-connected assets that fundamentally impact how the grid works but are owned or managed by third parties. Whether it’s an outage that requires rapid switching during restoration efforts or backing up a solar-loaded circuit on a cloudy day, utilities must take into account the influence of all that third-party generation they don’t control.

Perhaps someday, they will. One-third of survey respondents anticipate the coming of distribution markets for DER owners, and more than half — 55 percent — agreed that DERs will dominate utility service offerings in the next 15 years. For now, however, utilities are stuck planning for today and the long-haul.

What will they need to plan wisely? Visibility, for starters. Traditionally, utilities placed and managed all the assets on their grids. Now, they need to see what’s out there that is installed on the customer side of the meter or connected directly to the distribution system, which means more sensors on distribution circuits. Utilities also need more intelligent systems, such as advanced distribution management systems (ADMS), as well as more integration of data with operations and control systems at the grid edge.

All these things show up in the survey responses, indicating that utilities are focused on the right kinds of technology to help them deal with the rapid changes unfolding. In some instances, the increased visibility need requires the first step of an audit of what they have in their system — with photographs, survey points, materials, configuration data and asset condition updates — before they can proceed with grid modernization efforts.

All Charged Up

One of the biggest unknowns that utilities face is the impact of EV charging. Seven years ago, only a couple of model choices were available for would-be EV owners; now, there are more than 50. Medium- and heavy-duty trucks are starting to come to market, too. The Tesla Semi has been taking reservations for well over a year and is scheduled for production this year. Other semi original equipment manufacturers (OEMs) have semi pilots in various stages of deployment. UPS has been testing a variety of low-emission vehicles — 9,300 of them — and has stated a “mission of getting entire electric fleets on the road.”

Bloomberg New Energy Finance tracked 2 million EVs sold in 2018, up from just a few thousand in 2010. Bloomberg NEF analysts expect 57 percent of that support flexible system configurations; 45 percent of electricity providers want the same.

Here’s one thing all utilities share: They want to deliver safe, reliable and cost-effective power, all while challenged with generation and other grid-connected assets that fundamentally impact how the grid works but are owned or managed by third parties. Whether it’s an outage that requires rapid switching during restoration efforts or backing up a solar-loaded circuit on a cloudy day, utilities must take into account the influence of all that third-party generation they don’t control.

Perhaps someday, they will. One-third of survey respondents anticipate the coming of distribution markets for DER owners, and more than half — 55 percent — agreed that DERs will dominate utility service offerings in the next 15 years. For now, however, utilities are stuck planning for today and the long-haul.

What will they need to plan wisely? Visibility, for starters. Traditionally, utilities placed and managed all the assets on their grids. Now, they need to see what’s out there that is installed on the customer side of the meter or connected directly to the distribution system, which means more sensors on distribution circuits. Utilities also need more intelligent systems, such as advanced distribution management systems (ADMS), as well as more integration of data with operations and control systems at the grid edge.

All these things show up in the survey responses, indicating that utilities are focused on the right kinds of technology to help them deal with the rapid changes unfolding. In some instances, the increased visibility need requires the first step of an audit of what they have in their system — with photographs, survey points, materials, configuration data and asset condition updates — before they can proceed with grid modernization efforts.

All Charged Up One of the biggest unknowns that utilities face is the impact of EV charging. Seven years ago, only a couple of model choices were available for would-be EV owners; now, there are more than 50. Medium- and heavy-duty trucks are starting to come to market, too. The Tesla Semi has been taking reservations for well over a year and is scheduled for production this year. Other semi original equipment manufacturers (OEMs) have semi pilots in various stages of deployment. UPS has been testing a variety of low-emission vehicles — 9,300 of them — and has stated a “mission of getting entire electric fleets on the road.”

Bloomberg New Energy Finance tracked 2 million EVs sold in 2018, up from just a few thousand in 2010. Bloomberg NEF analysts expect 57 percent of global passenger cars sold by 2040 to be EVs. Electric buses could top 80 percent of municipal bus sales by the same year, and 56 percent of light-duty commercial vehicles could be EVs in the United States, Europe and China.

At this scale, many compare EV loads to what happened to the power market 50 years ago, when air conditioning started to take hold. These EV loads will impact the grid in many ways, but utilities still don’t know how. Are people going to charge vehicles at night, or are they going to charge at the workplace? What's the split for each option? And what impact will autonomous vehicles have? Will we see 10-MW charging hubs with 100 autonomous vehicles coming and going at different times of the day? And will charging infrastructure itself continue to draw increasingly more energy? Already, the size of the chargers is getting bigger; instead of 20 kilowatt (kW) to 100 kW, we’re now talking about 350- to 500-kW chargers coming online.

Smart utilities are studying the impacts, and some are finding surprises. For instance, even if a utility experiences a net-zero growth, investments may be needed because, through the electrification of transportation, the location of where people are using electricity and how they are using it changes. Traditionally, distribution planning relied upon power flow in one direction to the end users that are defined by a static collection of load profiles for various customer classes, but the increasing penetration of end-user-owned DERs, such as rooftop solar, brings the possibility of reverse power flow and the associated voltage regulation and stability issues as those energy resources come on and off line. And the shape of traditional customer load profiles when EV charging or DERs is included is dramatically different.

Black & Veatch did a study for a mid-size municipality that expected a negative net load growth in the future driven by the increase in customer self-generation. Utility managers anticipated declining capital infrastructure requirements. But when they evaluated the demographics of EV buyers, photovoltaic installations, and the geographic and socioeconomic parts of the city where these were starting to proliferate, they realized they were going to need to spend far more than they’d been spending on substations and transmission lines. The quantity, timing and location of energy consumption were changing so significantly that this municipality didn’t have substation capacity in the right places, and the daily load curves were shifting.

Some utilities are starting to look for ways to control that mobile load. More than half — 52 percent — said EV charging networks were among the new sources of revenue their utility was considering or already deploying.

Still, even if utilities gain some control over the coming charging loads, it will only make a small dent in managing a grid that is growing increasingly complicated and green. More than 70 percent of respondents named the coming generation mix — one with fewer traditional baseload units and more utility-scale renewables — as the biggest concern ahead regarding grid operations and maintenance.

Going forward, planning efforts will need to focus on expanding flexibility and creating a smarter, more integrated grid. For utilities, that may mean back-office systems such as ADMS, more distribution automation and smart inverters that enable DERs to support grid stability and expanded participation in markets. For example, charging stations themselves may someday support ancillary markets.

The grid is seeing demands that it hasn’t seen before. Despite the uncertainty, the smart move is to start planning early and trying to see all the impacts that may unfold.

Now is not the time to take your eyes off the road. There are too many curves ahead.

Arron Lewis is the global power distribution leader for Black & Veatch’s distributed energy business. In this role, Lewis leads the global deployment of services for power distribution infrastructure. His focus is on the delivery of new services to address digitization, grid modernization, as well as infrastructure construction and upgrades required to meet the evolving needs of utility clients that deliver power to customers.

Kevin Cornish is a senior managing director of the growth and performance practice in Black & Veatch’s management consulting business. Cornish focuses on providing support to utilities as they perform strategic business assessments, implement enabling technologies, and revamp engineering and business processes to improve their competitiveness and evolve with the changing grid.

Dean Siegrist is the associate vice president of Black & Veatch’s Transformative Technologies business. In this role, Siegrist leads the business that provides the vertically integrated services of site acquisition, design, permitting, construction and operation of distributed infrastructure with a focus on sustainable transportation. He works with vehicle OEMs, utilities, transit agencies, cities and emerging transportation service providers to plan and build infrastructure for the electrification transportation.