Southeast Asia is pushing ahead with energy transition strategies that balance security, sustainability and affordability goals.

The Philippines has conducted the opening of Applications for the 3rd Open and Competitive Selection Process (OCSP3) which now allows for 100 percent foreign participation in large-scale geothermal exploration, development, and utilization projects.

Singapore’s strategies for achieving a low carbon energy future include a SGD 49 million (US$36.6 million) Low-Carbon Energy Research Funding Initiative to support projects in low carbon energy technologies; increasing hydrogen developments; expanding solar deployment to 1.5 GWp by 2025; and piloting the nation’s first floating energy storage system.

Indonesia’s state-owned power company, State Electricity Corporation (PLN), plans to expand electricity access and promote renewable energy in eastern Indonesia with the US$600 million loan it has received from the Asian Development Bank (ADB).

Harry Harji, Associate Vice President, Black & Veatch Management Consulting - Asia, Middle East and Africa, shares insights into Southeast Asia’s energy transition.

What are key energy transition priorities in Southeast Asia?

Grid modernization and renewable energy integration will remain investment priorities as Southeast Asia expands its energy system to support rising demand created by growing populations and expanding economies.

One key priority in Southeast Asia is enhancing energy security and grid resilience with supply that is reliable and sustainable. This priority is creating opportunities in renewable energy integration, energy markets modernization, smarter grid management planning and automation.

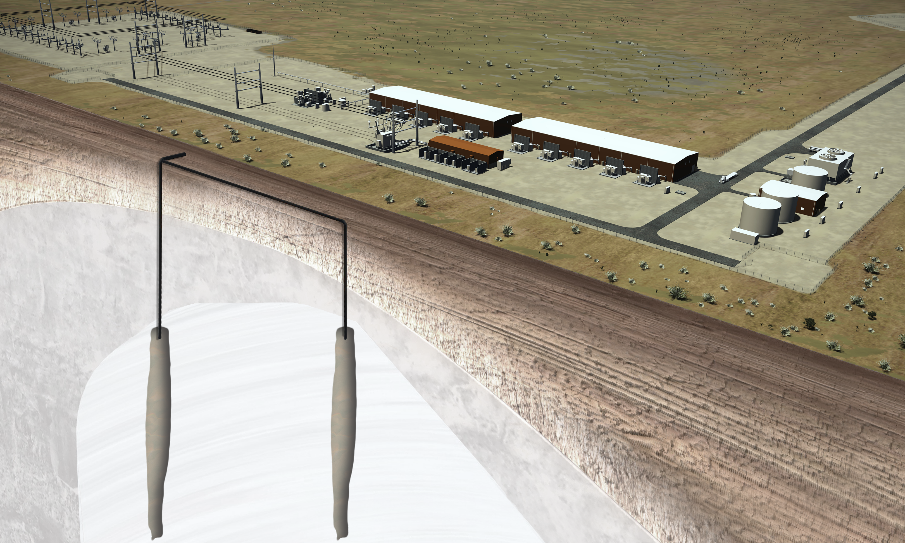

Another key priority in the region is rural electrification. Addressing rural electrification is creating opportunities for distributed power generation. Distributed energy resources (DER) like microgrids can provide the power reliability that remote locations need while ensuring the facilities are commercially viable.

Renewable energy, a key pillar of DER, can provide energy access in rural areas where grid extension may not be possible or economical due to geographical challenges. To enhance grid resilience, renewable energy can be paired with energy storage and integrated grid balancing solutions to balance generation variability while meeting decarbonization targets.

DERs can also boost energy resilience by functioning as independent nodes to support interconnected power and grid solutions distributed across traditional networks.

With multiple moving parts in an energy transition, how would grid management and operation be impacted?

Multiple moving parts in an energy transition have significantly increased the complexity of grid management and operation. Digital applications can help to manage grid operations more efficiently.

For example, understanding potential risks and mitigating them before they turn into real threats can help to reduce operation and maintenance costs as well as provide valuable insights for power system investments, planning, and regulatory adaptation.

Digital applications, like Asset Performance Management (APM) systems, deliver actionable insights for continuous performance improvements of assets. Core APM software capabilities, including asset condition monitoring, health and asset indexing, risk prioritization, inventory management, predictive and prescriptive analytics, can help to minimize unplanned failures or outages, and improve the operational efficiency of power related assets.

Understanding the operational state of the assets will help to address core technical challenges of grid stabilization, peak load management, system flexibility, reliability, and related investment decisions in a holistic manner.

In hybrid power installations, APM systems can track the reliability and integrity of solar photovoltaic (PV) panels, inverters, energy storage, system performance, and operating and capital expenses as they move through the lifecycle of a project. For distributed energy portfolios, APM systems can track the actual performance of individual projects and technologies utilized within these projects.

Digitalization also provides the opportunity for holistic management of distributed portfolios across different capacities and installations. For instance, insights drawn from data analytics can help to identify the weakest link in the distributed energy portfolio. If one project is not performing on a rooftop, how will that affect the entire portfolio in terms of revenue? When should equipment be replaced, maintained and optimized to lower maintenance costs? If the projects start generating different half hourly performance, how does that impact the grid, availability of the project or site to generate power to meet returns and generate revenues?

Measuring and forecasting project and portfolio performance accurately can provide lenders such as funds, banks and insurers, the reassurance needed to lower the lending rates.

What factors would influence the success of Southeast Asia’s energy transition?

One factor that would influence the success of Southeast Asia’s energy transition is the ability to attract investments. Therefore, developing bankable renewable energy projects are essential.

Project planning, returns and risk allocation are some key considerations investors prioritize when assessing project bankability. Key concerns from the investment community include: Who is integrating the different technologies? What is the quality of construction and build? Have appropriate feasibility studies been conducted? With respect to the integrity of the installations, are they being properly maintained after they are constructed?

Efficient and flexible grid operations is one approach that can help to reduce the cost of managing grid performance risks. Digitalization of the power generation industry, along with grid planning improvements, integration of smart energy solutions, and accurate valuation and management of power systems, can enable flexible grid operations.

With the Southeast Asia electric industry becoming increasingly complex due to ever-changing economic outlooks, technological trends, user demand, and policy drivers, the power sector will need partners who can help to navigate this new environment.

Technology-agnostic partners are well-placed to provide integrated strategy, transaction advisory, business operations, regulatory and technology solutions to the Asia power industry. Partners who offer expertise in advanced analytics and practical business sense with extensive technology and engineering capabilities will be able to provide solutions that add value at every point of the infrastructure life cycle.

This article was first published in SME Asia (Issue 15, page 12-14).