Signed into law in late 2021, the Infrastructure Investment and Jobs Act (IIJA) — or the Bipartisan Infrastructure Law (BIL) — was hailed as a golden moment for the U.S. water industry, promising tens of billions of dollars in federal funding for the sector that for decades has grappled with chronically aging infrastructure.

With more than $50 billion noted as the largest federal investment in water in U.S. history, the funding measure was heralded as a long-overdue way to upgrade and replace a labyrinth of old, worrisome and often failing drinking water, wastewater and stormwater infrastructure. This is all happening at a time of rising urgency in remediating lead service lines, addressing and reporting regulatory compliance with constrained resources and mitigating other issues associated with outdated systems. It’s tough for utilities to sort through this funding and determine what can best be leveraged for their specific needs.

So, more than a year and a half later, are water utilities benefiting from these government funding opportunities, or are there obstacles impeding the path to progress? Black & Veatch’s 2023 Water Report, based on expert analyses of a survey of some 450 U.S. water sector stakeholders, shows an industry welcoming federal help, but not yet taking full advantage of it for various reasons.

Barriers to Participating in Funding Programs

Encouragingly, a combined 83 percent of survey respondents either are very likely or somewhat likely to use the available funding programs — results consistent across utilities of all sizes. But a huge disconnect exists between enthusiasm for this funding and actual implementation.

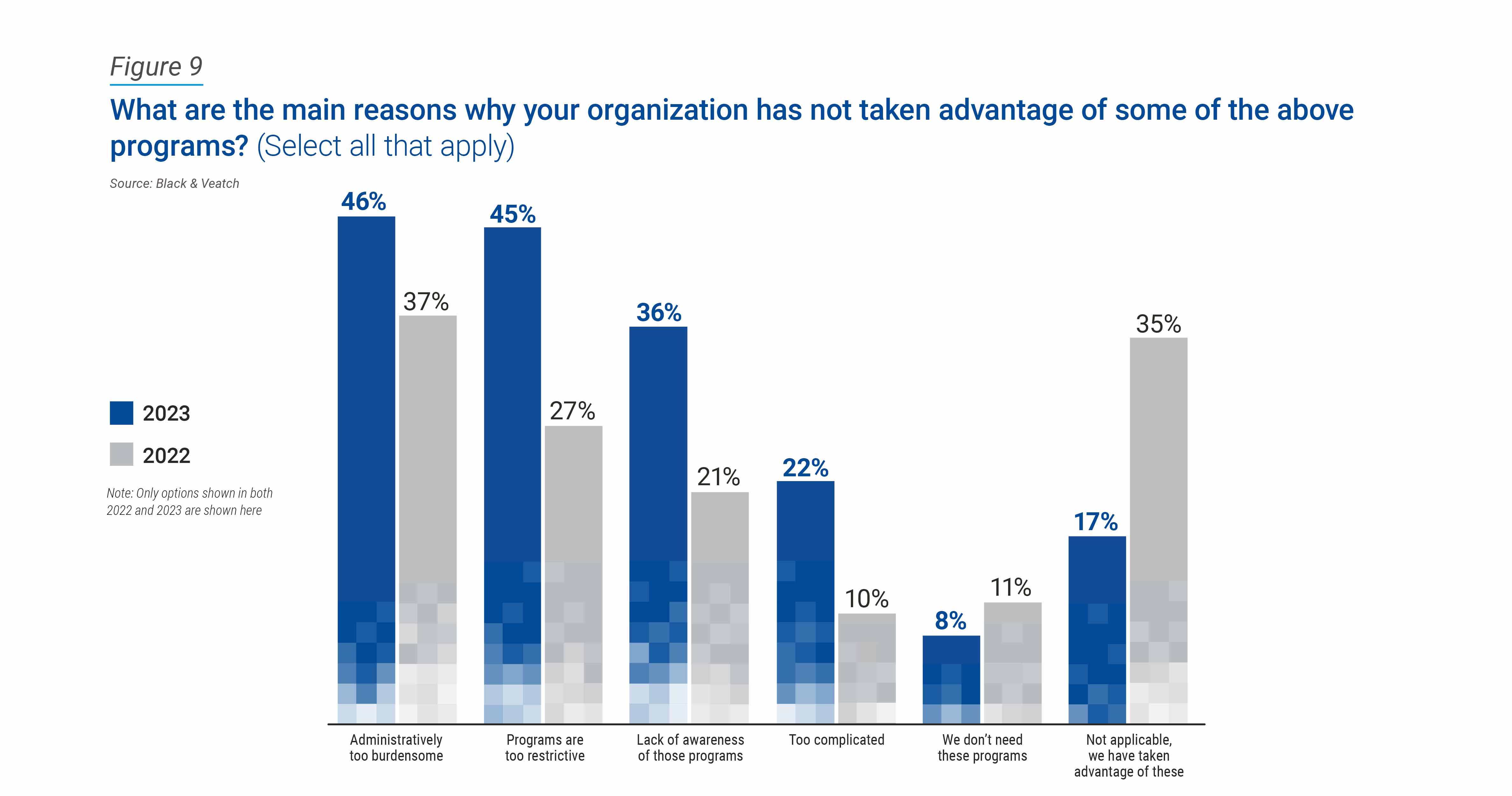

While most water utilities appear willing to take advantage of government funding mechanisms, nearly half of respondents — 46 percent — find the process administratively burdensome, with a nearly identical number viewing it as too restrictive. Only a few states have well-defined processes to apply for and distribute the funds, but many still are working on the “how” process of this new money, even though it is flowing through the existing state revolving fund (SRF) programs. These barriers aren’t limited to just IIJA funds; we’re also seeing some American Rescue Plan Act (ARPA) funds that haven’t been obligated, even with the approaching deadline.

Viewing this through the prism of utility size, smaller utilities — those serving a population of less than half a million — are encountering even more funding obstacles than larger utilities. More than half — 52 percent — of smaller utilities say funding programs are administratively too burdensome. In comparison, 48 percent lack awareness of these programs and 36 percent know about the programs but don’t know how to pursue the funds. This makes sense, given that larger utilities with at least 500,000 customers typically have more sophisticated processes in seeking funding and greater staff capacity to pursue the funds.

When comparing this year’s survey results to those of 2022, such frustrations are exacerbated; for example, in 2022, only 27 percent of survey respondents said that the programs were too restrictive, but that figure jumped to 45 percent this year (Figure 9).

Greater Constraints on IIJA Funding

As part of the IIJA, the “Buy America, Build America Act” (BABAA) requires that any infrastructure project receiving federal funding as of May 2022 must procure iron, steel, manufactured products and construction materials from within the United States.

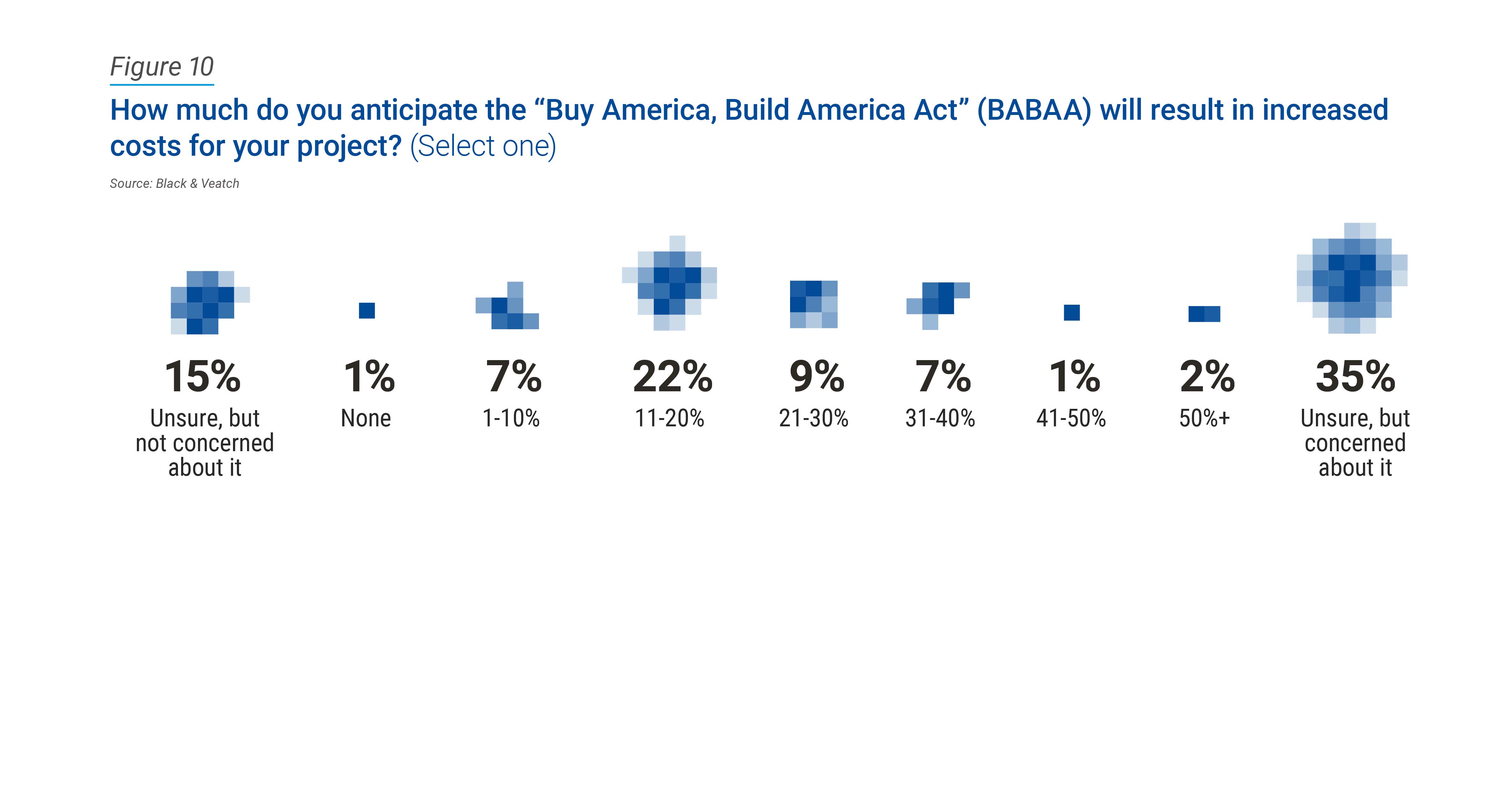

Most trade association lobbies strongly opposed BABAA and have lobbied for amendments and waiver options since its passage. More than one in five respondents — 22 percent — said they anticipate BABAA will increase project costs by 11 to 20 percent, while 35 percent said they were unsure of the percentage but were concerned about it. Only 1 percent said they don’t think it will affect costs (Figure 10). The data reveals the water sector’s uncertainty around the future cost and schedule impact of BABAA. This is particularly true given the broader market trends of higher inflation and supply chain issues, which could be exacerbated by BABAA. Regardless, many utilities are feeling discouraged by these “strings attached” to receiving federal funding.

Major Investments in Several Key Areas

Regardless of whether they will leverage federal funding, water utilities and local municipalities intend to make major investments in various categories over the next decade.

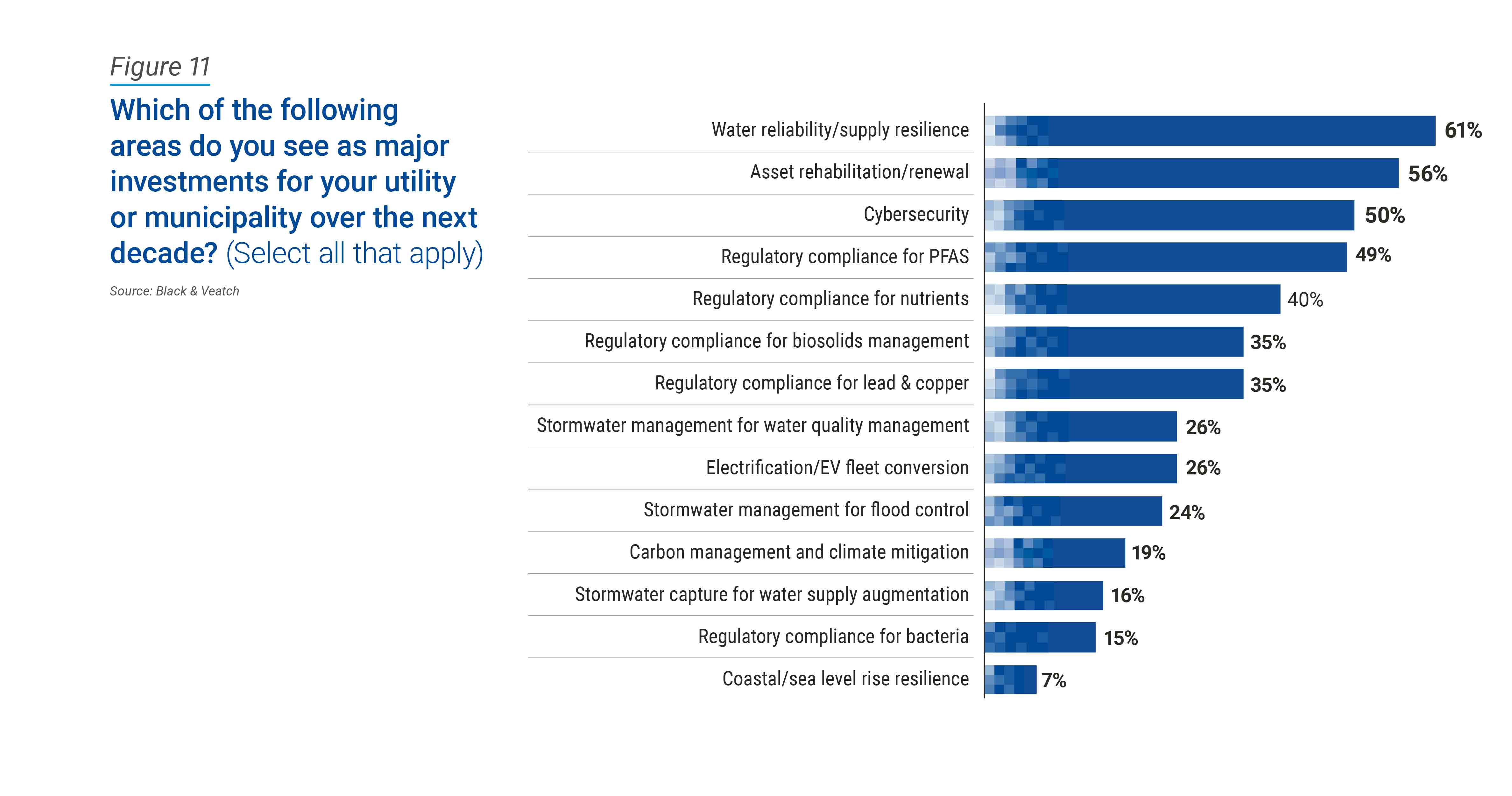

Most survey respondents identified water supply reliability (61 percent), asset rehabilitation (56 percent) and cybersecurity (50 percent) as their top priorities (Figure 11). It’s worth noting that when comparing 2023 and 2022 results, emphasis on cybersecurity, regulatory compliance for lead and copper, electric vehicle (EV) fleet conversion and resilience to sea level rise dropped significantly.

The slight increase in polyfluorinated substances (PFAS) aligns with the U.S. Environmental Protection Agency’s (EPA) latest National Primary Drinking Water Regulation (NPDWR); priorities have certainly shifted from lead and copper to these so-called “forever chemicals,” especially as a result of the IIJA’s $10 billion in PFAS funding.

The decrease in regulatory compliance for lead and copper is slightly puzzling, given the IIJA’s $15 billion still allocated for lead pipe replacement, but may be explained by the higher focus on lead service lines in 2022 with the passage of the EPA’s Lead and Copper Rule (LCR) in December 2021. The decreased investments in sea level rise resilience perhaps could be attributed to the geographic locations of those surveyed; utilities located outside of coastal areas have far less reason to be concerned about that matter. Similarly, PFAS and lead service lines don’t apply to all geographies, while cybersecurity does.

Navigating the Funding Process

The bottom line: there’s a lot of money on the table, but perceptions remain that the money is hard to reach and comes with constraints.

Taking full advantage of federal funding — whether in the form of grants, low-interest loans or tax credits — requires an understanding of the wide array of available options. In the past, government funding had very specific categories for water infrastructure, but utilities now may consider additional funding such as renewable energy or electric vehicle tax credits. It’s time to think beyond water — power, telecommunications, cybersecurity and disaster recovery play a huge role in utility operations as well.

Over the past couple of years, the water sector has seen high enthusiasm and equally high expectations for new funding opportunities. As implementation of these programs progresses, utilities and municipalities are approaching them with caution and confusion, especially regarding project cost increases associated with BABAA.

Many water utilities and local municipalities are reaching for help to navigate the complexities of identifying available funding and how to tap it, seeking out trusted, expert advisors versed in optimizing the potential catalytic impact the new funding infusion presents.

When Black & Veatch began identifying funding options for a California utility client, for instance, the project design already was complete and ready for bid, and financing needs were the only barrier to moving ahead. Black & Veatch helped the utility secure a $50 million Water Infrastructure Finance and Innovation Act (WIFIA) loan and apply for a $45 million Federal Emergency Management Agency (FEMA) grant for a large dam replacement project.

Another Black & Veatch client in the Midwest recently sought to finance a capital improvements program (CIP) integrating stormwater, sewer and green infrastructure elements to mitigate flooding, make critical repairs and improve water quality. Without alternative funding options, that client would have to scale back its scope heavily; instead, Black & Veatch is helping secure WIFIA and SRF loans for this $150 million CIP.

As demand remains high for such funding, water utilities should aggressively look to satisfy their big appetites for growing and accelerating infrastructure improvements that positively impact their communities and customers’ quality of life.