Timing is everything, and the political whipsaw that was the summer of 2022 highlighted this in Technicolor®. Each year, as we consider the topics and questions to be addressed in our annual Black & Veatch Electric Report, we understand we’re capturing a moment in time in the perspectives of our survey respondents. For a section focused on the potential impact of government funding — including the Infrastructure Investment and Jobs Act (IIJA) — on the future of the grid, our timing arguably couldn’t be worse.

How so? After weeks of careful planning, imagine our surprise as our survey launched to reports that the remaining clean energy elements of the “Build Back Better” framework were dead in the water, only to close it out a few weeks later with late-breaking word the Manchin-Schumer “Inflation Reduction Act” was alive and well, ultimately making its way through Congress and being signed into law.

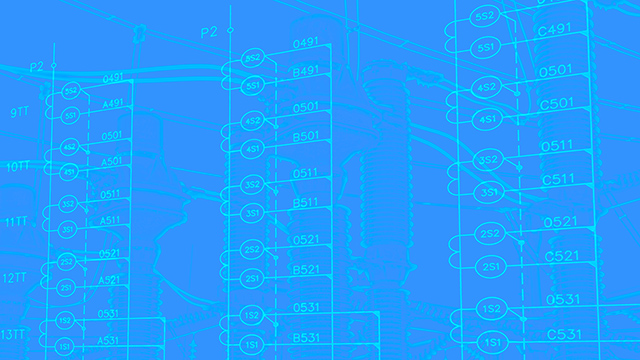

With that backdrop in mind, we were struck by several themes emerging in 2022, including that government funding though the IIJA is expected to play a role in underpinning investment decisions for nearly 60 percent of respondents. This includes nearly two-thirds of those serving less than 2 million customers, demonstrating a favorable outlook on the role of federal funding in their planning. Optimistically, given the broad financial incentives targeting clean energy in the Inflation Reduction Act, and its passage through budget reconciliation, we expect these figures would reflect even greater optimism in a follow-up survey (Figures 4-5)

Timing aside, when it comes to expectations of how and where IIJA funding for grid-related projects will be prioritized, two areas — EV charging infrastructure and energy storage — were clear winners. This is consistent with the considerable efforts of the Biden Administration to support growth in the electrification of transportation, highlighted by the call to deploy 500,000 charging stations nationwide. The fact that federal funding will support the millions of EVs entering service and provide a significant business opportunity to a market that experienced years of flat load growth is not lost on industry stakeholders. Similarly, awareness of the critical role energy storage will play in providing grid-balancing support comes as the pace of renewable energy deployment accelerates. Grid resilience to climate impacts, cybersecurity and a series of interconnected elements round out a range of choices reflecting the competing priorities within the broader grid modernization effort (Figure 6).

For as much as the electric sector seeks to decide its own fate, policy and regulatory uncertainty represent the greatest factors impacting decisions to invest in electric sector infrastructure, followed closely by concerns over technology time horizons. Simply put, political decisions being made to drive decarbonization and evolve the regulatory compact reshape how service providers can look at a range of capital and operational expense planning scenarios. For example, in California, the state acknowledges its need to deploy large-scale natural gas technologies to ensure grid reliability, but its decision to phase out natural gas by 2045 means these technologies are to be taken out of service before the traditional asset lifecycle is complete, disrupting traditional market dynamics (Figure 7).

One area where respondents are shedding significant insight relates to the ongoing challenges the Department of Energy (DOE) faces in streamlining the complex process of securing government funding for energy projects. Fully 35 percent of survey participants indicated their organization would not pursue funding due to factors ranging from lack of awareness to overly restrictive conditions or administratively burdensome applications.

With the passage of the Inflation Reduction Act, the DOE now has roughly $110 billion in loan authority to support innovative clean energy, advanced transportation and tribal energy projects. But to receive funding, the DOE must be comfortable with a project plan that addresses everything from design through commercial operation. The DOE’s commitment of $504 million for the Advanced Clean Energy Storage green hydrogen production and storage project in Delta, Utah, reflected their confidence in the comprehensive framework the development partners and engineering, procurement and construction (EPC) provider developed to meet their standards. Working with stakeholders who understand the DOE’s approval processes will be essential to accelerating the flow of capital to worthy programs.

Despite the timing of our survey, we find reasons for optimism abound throughout this report. Efforts to address the digital and advanced infrastructure divide, highlighted during the COVID-19 pandemic, are top of mind for more than three-quarters of 2022 respondents. This reflects the industry’s effort to ensure that breakthroughs in clean energy will be deployed and benefit low-income communities in both urban and rural parts of the nation.

From a funding perspective, which cannot be overlooked as typically the most challenging aspect in developing next-generation infrastructure programs, billions of dollars in investment will be fueled by tax credits, loan programs and direct investment from the American taxpayer. This effort to modernize our grid reflects the type of transformative, Hoover Dam-like project that will reimagine countless sectors and decarbonize the U.S. economy.